DIY Bookkeeping for Solopreneurs

Contributed by Idea Collective Member:

Rachel LaMantia

Masterpiece Bookkeeping, LLC

You're just starting out and you have a small but growing service-based business. Where do you start?

You know you need to track all of the money stuff; there is a thing called taxes…but how? Everyone says you should get QuickBooks…but should you? There is an easier way! Read on for instructions to DIY your books from a workshop I’ve done for freelancers, in way less time than you think it will take.

tip

Use a separate bank account for your business

The first thing you should do is use separate accounts for your business. This is going to make everything SO much easier to track. Set up a separate checking account in the business name (if you have one, or in your name if you do not have an LLC). If you want to use a credit card, get a separate card for the business. This counts for services like PayPal too! If you have more than one business, have separate accounts for each one.

Personal transactions go through personal accounts. Business transactions go through business accounts. Period.

You can transfer funds between the two accounts as needed. To fund things in your business when you’re getting started, transfer funds into the business account from your personal account. To pay yourself, transfer funds from the business account to your personal account.

The Easy way to DIY Bookkeeping for Solopreneurs

Here’s a secret: you don’t need fancy software. I actually recommend against it in many cases as there is a large learning curve and most people haven’t studied the accounting that goes on behind the scenes. I talk more about software choices in this article.

When your business is small and uncomplicated, try using a spreadsheet. Once you have it set up the first time, it should take you maybe half an hour a month. Create a file in your favorite spreadsheet software and follow the steps below.

Step 1

Each month, download a spreadsheet or .csv file from your business bank account of your transactions for the previous month. Copy and paste this into a “master” tab of your spreadsheet.

If you have multiple accounts, download the activity for each account. If the export is formatted differently per account, you will want to make sure all of the amounts end up in the same column in your master spreadsheet. You really only need three columns: date, description, and amount (sometimes amounts are split into two columns).

Step 2

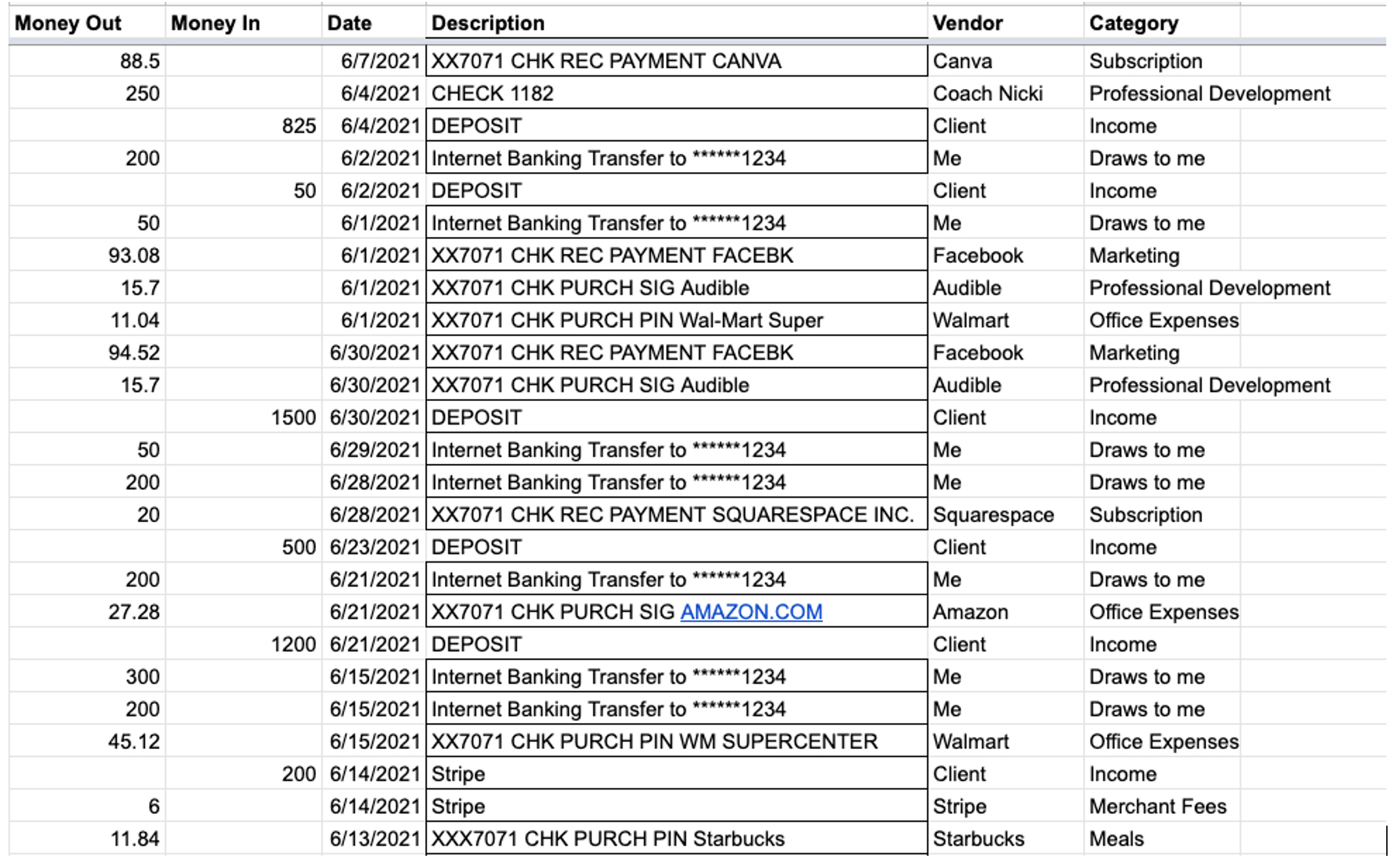

Categorize your transactions. Add another column on your master spreadsheet for category, then go down your transaction list and fill in the category column. Income gets labeled income, and expenses get broken down into categories. The goal here is to have a few large categories, maybe ten max. For example, all things related to marketing go into that one category (you don’t have to split out printed stuff, website stuff, and social media stuff). You could fill out a second additional column for Vendor/Customer, which is often helpful. It should look something like the picture below.

There may be occasions where you need to split one transaction into two (for example, if you have fees taken out of income deposits). In this case, add a new row, copy the one that needs to be split, and then adjust the amounts for each category.

Step 3

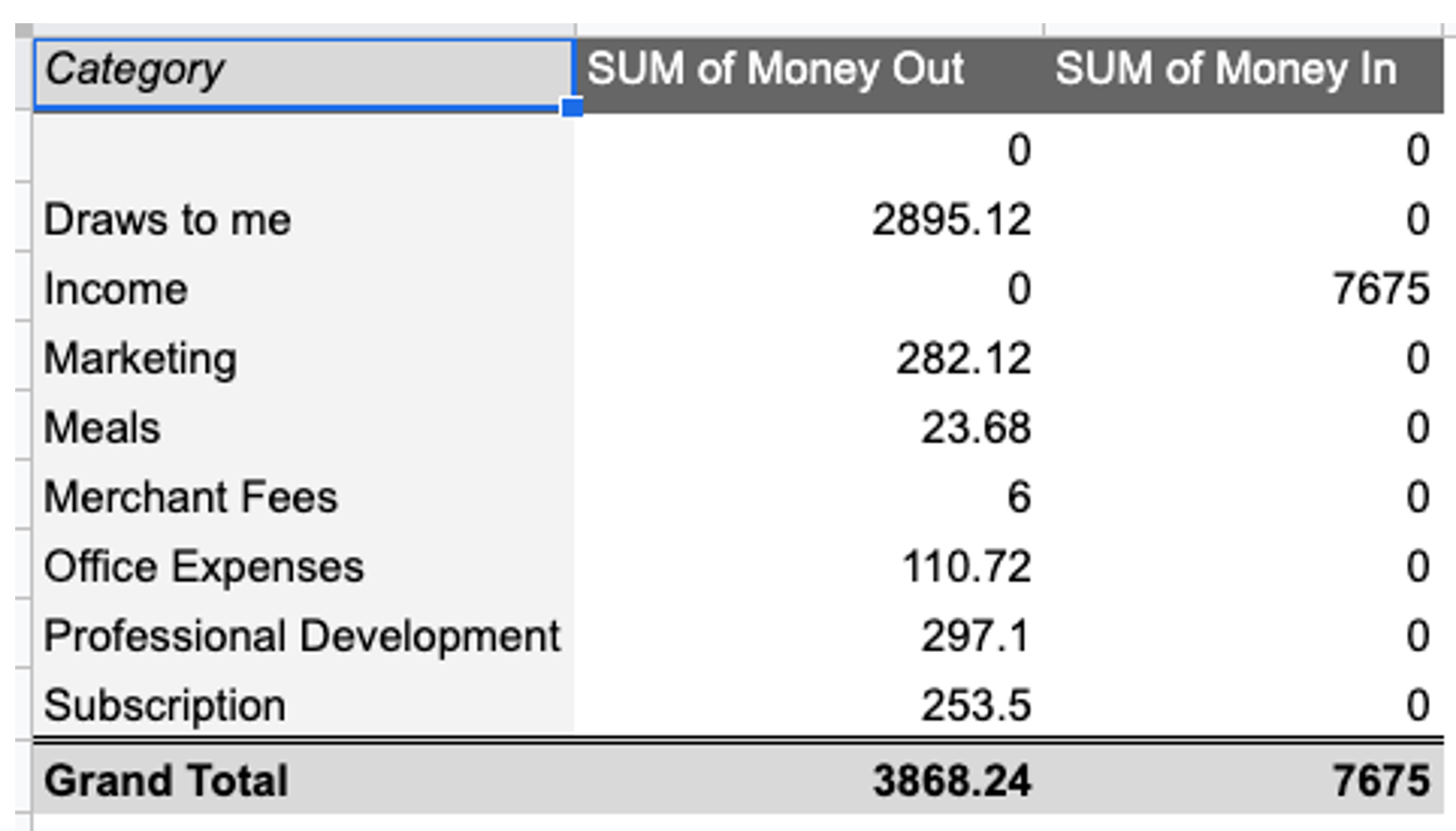

Create a pivot table to get a summary of your income and expenses. This isn’t as hard as it sounds, I promise! When you do the pivot table, put in a new tab, add rows by category, and add a value as the sum of your amount column (do this twice if your amounts are in two columns). You will only have to set this up once and it will update as you add more to your master tab. Example below.

That’s it! Repeat steps 1 and 2 every month, adding to the master spreadsheet. Start a new master tab and pivot table (step 3) each January for the new year.

When should you think about hiring a pro?

This DIY method is fantastic if your business is small and uncomplicated, but it doesn’t always work for everyone. There are many situations where you shouldn’t use the spreadsheet method or DIY at all. Here are some of the Top DIY Bookkeeping Mistakes we see.

Reasons to hire out your bookkeeping:

You’re not an accountant, you shouldn’t have to learn accounting software. Spend a little bit of time downloading and categorizing transactions each month, and then go work on growing your business with peace of mind that your numbers are in order!

Contributed by

Rachel LaMantia

Masterpiece Bookkeeping, LLC

A math-loving Wisconsin girl, Rachel has a heart for entrepreneurs. She understands their challenges and sympathizes with the complexities of running a business while balancing the daily to-dos and strategically planning for financial security.